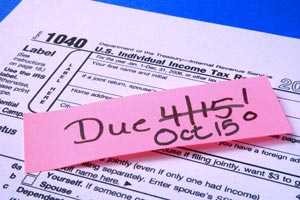

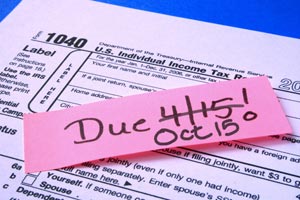

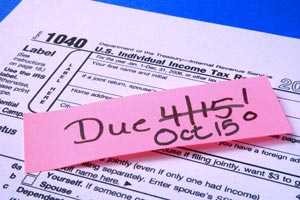

The Internal Revenue Service today reminded taxpayers that the Oct. 15 deadline remains in effect for people who requested a six-month extension to file their tax return.

The current lapse in federal appropriations does not affect the federal tax law, and all taxpayers should continue to meet their tax obligations as normal. Individuals and businesses should keep filing their tax returns and making deposits with the IRS, as required by law.

Many of the more than 12 million individuals who requested an automatic six-month extension earlier this year have yet to file their Form 1040 for 2012.

Though Oct. 15 is the last day for most people to file, some groups still have more time, including members of the military and others serving in Afghanistan or other combat zone localities who typically have until at least 180 days after they leave the combat zone to both file returns and pay any taxes due. People with extensions in parts of Colorado affected by severe storms, flooding, landslides and mudslides also have more time, until Dec. 2, 2013, to file and pay.

The IRS offered several reminders for taxpayers during the current appropriations lapse:

Taxpayers are encouraged to file their returns electronically using IRS e-file or the Free File system to reduce the chance of errors.

Taxpayers can file their tax returns electronically or on paper. Payments accompanying paper and e-filed tax returns will be accepted and processed as the IRS receives them. Tax refunds will not be issued until normal government operations resume.

IRS operations are limited during the appropriations lapse, with live assistors on the phones and at Taxpayer Assistance Centers unavailable. However, IRS.gov and most automated toll-free telephone applications remain operational.

Tax software companies, tax practitioners and Free File remain available to assist with taxes during this period.

Check Out Tax Benefits

Before filing, the IRS encourages taxpayers to take a moment to see if they qualify for these and other often-overlooked credits and deductions:

Benefits for low-and moderate-income workers and families, especially the Earned Income Tax Credit. The special EITC Assistant can help taxpayers see if they’re eligible.

Savers credit, claimed on Form 8880, for low-and moderate-income workers who contributed to a retirement plan, such as an IRA or 401(k).

American Opportunity Tax Credit, claimed on Form 8863, and other education tax benefits for parents and college students.

Same-sex couples, legally married in jurisdictions that recognize their marriages, are now treated as married, regardless of where they live. This applies to any return, including 2012 returns, filed on or after Sept. 16, 2013. This means that they generally must file their returns using either the married filing jointly or married filing separately filing status. Further details are on IRS.gov.

E-file Now: It’s Fast, Easy and Often Free

The IRS urged taxpayers to choose the speed and convenience of electronic filing. IRS e-file is fast, accurate and secure, making it an ideal option for those rushing to meet the Oct. 15 deadline. The tax agency verifies receipt of an e-filed return, and people who file electronically make fewer mistakes too.

Everyone can use Free File, either the brand-name software, offered by IRS’ commercial partners to individuals and families with incomes of $57,000 or less, or online fillable forms, the electronic version of IRS paper forms available to taxpayers at all income levels.

Taxpayers who purchase their own software can also choose e-file, and most paid tax preparers are now required to file their clients’ returns electronically.

Anyone expecting a refund can get it sooner by choosing direct deposit. Taxpayers can choose to have their refunds deposited into as many as three accounts. See Form 8888 for details.

Of the nearly 141.6 million returns received by the IRS so far this year, 83.5 percent or just over 118.2 million have been e-filed.

Payment Options

Taxpayers can e-pay what they owe, either online or by phone, through the Electronic Federal Tax Payment System (EFTPS), by electronic funds withdrawal or with a credit or debit card. There is no IRS fee for any of these services, but for debit and credit card payments only, the private-sector card processors do charge a convenience fee. For those who itemize their deductions, these fees can be claimed on next year’s Schedule A Line 23. Those who choose to pay by check or money order should make the payment out to the “United States Treasury”.

Taxpayers with extensions should file their returns by Oct. 15, even if they can’t pay the full amount due. Doing so will avoid the late-filing penalty, normally five percent per month, that would otherwise apply to any unpaid balance after Oct. 15. However, interest, currently at the rate of 3 percent per year compounded daily, and late-payment penalties, normally 0.5 percent per month, will continue to accrue.

Fresh Start for Struggling Taxpayers

In many cases, those struggling to pay taxes qualify for one of several relief programs. Most people can set up a payment agreement with the IRS on line in a matter of minutes. Those who owe $50,000 or less in combined tax, penalties and interest can use the Online Payment Agreement to set up a monthly payment agreement for up to 72 months or request a short-term extension to pay. Taxpayers can choose this option even if they have not yet received a bill or notice from the IRS.

Taxpayers can also request a payment agreement by filing Form 9465. This form can be downloaded from IRS.gov and mailed along with a tax return, bill or notice.

Alternatively, some struggling taxpayers qualify for an offer-in-compromise. This is an agreement between a taxpayer and the IRS that settles the taxpayer’s tax liabilities for less than the full amount owed. Generally, an offer will not be accepted if the IRS believes the liability can be paid in full as a lump sum or through a payment agreement. The IRS looks at the taxpayer’s income and assets to make a determination regarding the taxpayer’s ability to pay. To help determine eligibility, use the Offer in Compromise Pre-Qualifier, a free online tool available on IRS.gov.

Courtesy of the Internal Revenue Service.

Visit our website at www.Hoorfarlaw.com.