The on-again, off-again sale of the former Buffets Inc. empire is on again: Fresh Acquisitions, the owner of Old Country Buffet, HomeTown Buffet, Tahoe Joe’s and other concepts, has another buyer, restaurantbusinessonline.com reported. This time it’s Serene Investment Management, an investment firm that had previously bought up the debt to FoodFirst Global Restaurants before its bankruptcy filing.

Serene has made a stalking-horse bid of $4.2 million to buy Fresh Acquisitions out of bankruptcy, including $3.2 million, plus another $1 million in lease costs, according to court documents. The deal also includes warrants that could make the sale price more valuable, depending on the company reaching certain milestones. The auction is set to be held within two weeks, according to court documents. This is the second time that the buffet company has had a stalking-horse bidder and a scheduled auction since its April bankruptcy filing. Fresh Acquisitions declared bankruptcy with just six Tahoe Joe’s restaurants open — or less than one-one hundredth of the 650 locations it had at its peak in 2006, when it was known as Buffets Inc.

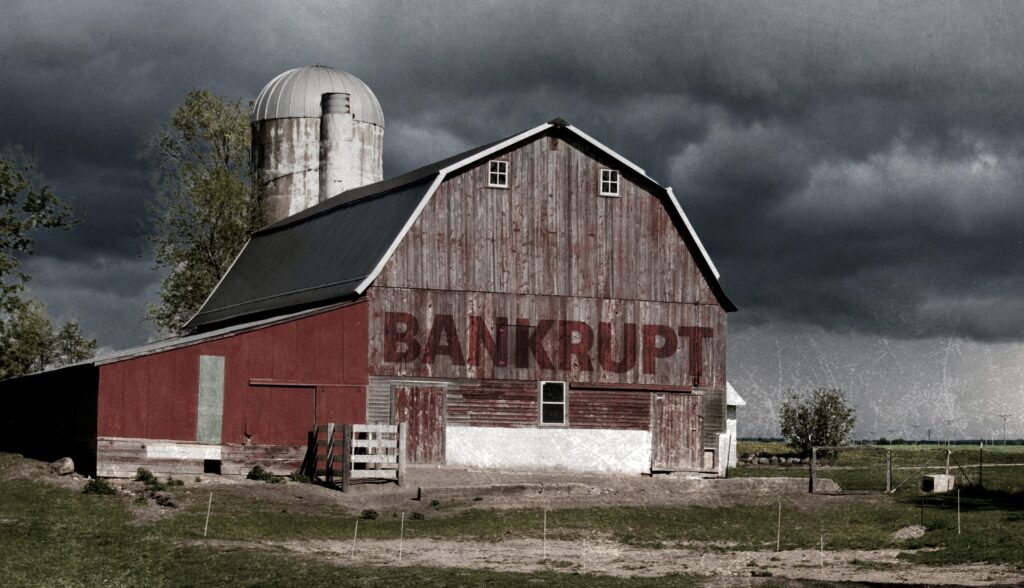

Thinking about filing bankruptcy? Contact our office at (816) 524-4949 or visit our website at hoorfarlaw.com and make an appointment to discuss if that is your best option.